Prospectus Supplement Filed Pursuant to Rule 424(b)(3)

Registration No. 333-205232

PROSPECTUS SUPPLEMENT NO. 3

DATED APRIL 29, 2016

(To Prospectus Declared Effective on October 21, 2015

and Dated October 22, 2015)

LM FUNDING AMERICA, INC.

Maximum of 2,000,000 Units

Minimum of 1,200,000 Units

Each Unit Consisting of One Share of Common Stock and One Warrant

This Prospectus Supplement No. 3 supplements information contained in, and should be read in conjunction with, that certain Prospectus, dated October 22, 2015, of LM Funding America, Inc., as supplemented by that certain Prospectus Supplement No. 1, dated December 3, 2015 (“Supplement No. 1”), and Prospectus Supplement No. 2, dated January 21, 2016 (“Supplement No. 2”) relating to the offer and sale by us of up to 2,000,000 units, each unit consisting of one share of common stock and one warrant. This Prospectus Supplement No. 3 is not complete without, and may not be delivered or used except in connection with, the original Prospectus, Supplement No. 1 and Supplement No. 2.

This Prospectus Supplement No. 3 includes the following documents, as filed by us with the Securities and Exchange Commission:

|

|

· |

The attached Annual Report on Form 10-K of LM Funding America, Inc., as filed with the Securities and Exchange Commission on March 30, 2016. |

|

|

· |

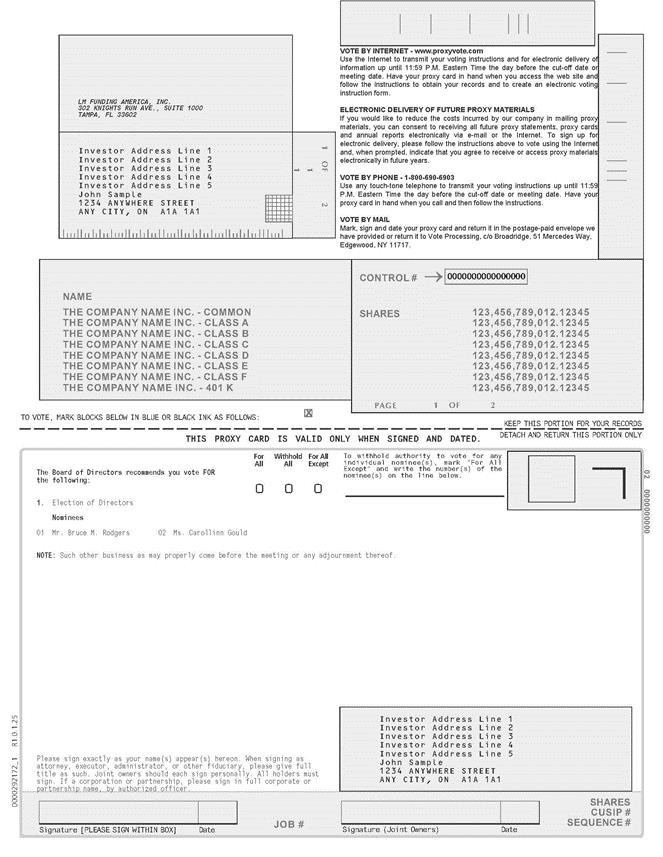

The attached Definitive Proxy Statement on Schedule 14A of LM Funding America, Inc., as filed with the Securities and Exchange Commission on April 29, 2016. |

Our units began trading on the Nasdaq Capital Market under the symbol “LMFAU.” When the units were split into their component parts, the units ceased trading and our ordinary shares and warrants began trading separately on the Nasdaq Capital Market under the symbols “LMFA” and “LMFAW” respectively.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this Prospectus Supplement No. 3 (or the original Prospectus or Supplement No. 1 and Supplement No. 2 thereto) is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement No. 3 is April 29, 2016.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37605

LM FUNDING AMERICA, INC.

(Exact name of Registrant as specified in its Charter)

|

Delaware |

47-3844457 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

302 Knights Run Avenue Suite 1000 Tampa, FL |

33602 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (813) 222-8996

Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $0.001 Per Share; Common stock traded on the NASDAQ stock market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

¨ (Do not check if a small reporting company) |

|

Small reporting company |

|

x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

As of June 30, 2015, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s common stock was not listed on any exchange or over-the-counter market. The registrant’s common stock began trading on The NASDAQ Stock Market on December 8, 2015. The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on December 31, 2015, was $28,083,000.

The number of shares of Registrant’s Common Stock outstanding as of December 31, 2015 was 3,300,000.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders, scheduled to be held on June 16, 2016, are incorporated by reference into Part III of this Report.

|

|

|

Page |

|

|

|

|

|

Item 1. |

3 |

|

|

Item 1A. |

7 |

|

|

Item 1B. |

17 |

|

|

Item 2. |

17 |

|

|

Item 3. |

17 |

|

|

Item 4. |

18 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

19 |

|

|

Item 6. |

19 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

Item 7A. |

24 |

|

|

Item 8. |

24 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

24 |

|

Item 9A. |

24 |

|

|

Item 9B. |

24 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

25 |

|

|

Item 11. |

25 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

25 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

25 |

|

Item 14. |

25 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

26 |

2

We are a specialty finance company that provides funding to nonprofit community associations primarily located in the state of Florida and, to a lesser extent, nonprofit community associations in the states of Washington and Colorado. As of February 2016, we also began operations in Illinois, which is the fourth-largest assessment market in the United States for community associations. We offer incorporated nonprofit community associations, which we refer to as “Associations,” a variety of financial products customized to each Association’s financial needs. Our original product offering consists of providing funding to Associations by purchasing their rights under delinquent accounts that are selected by the Associations arising from unpaid Association assessments. Historically, we provided funding against such delinquent accounts, which we refer to as “Accounts,” in exchange for a portion of the proceeds collected by the Associations from the account debtors on the Accounts. More recently, we have started purchasing Accounts on varying terms tailored to suit each Association’s financial needs, including under our New Neighbor Guaranty™ program. We believe that revenues from the New Neighbor Guaranty program, as well as other similar products we may develop in the future, will comprise an increasingly larger piece of our business during the next few years, and we intend to seek to leverage these products to expand our business activities and growth in the states in which we operate.

Under our original business, we purchase Associations’ right to receive a portion of the Association’s collected proceeds from owners that are not paying their assessments. After taking assignment of an Association’s right to receive a portion of the Association’s proceeds from the collection of delinquent assessments, we engage law firms to perform collection work on a deferred billing basis wherein the law firms receive payment upon collection from the account debtors or a predetermined contracted amount if payment from account debtors is less than legal fees and costs owed. Under this business model, we typically fund an amount equal to or less than the statutory minimum an Association could recover on a delinquent account for each Account, which we refer to as the “Super Lien Amount”. Upon collection of an Account, the law firm working on the Account, on behalf of the Association, generally distributes to us the funded amount, interest, and administrative late fees, with the law firm retaining legal fees and costs collected, and the Association retaining the balance of the collection. In connection with this business, we have developed proprietary software for servicing Accounts, which we believe enables law firms to service Accounts efficiently and profitably.

Under the New Neighbor Guaranty program, an Association will generally assign substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payment by us of monthly dues on each delinquent unit. This simultaneously eliminates a substantial portion of the Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed monthly payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the program enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables. We intend to leverage our proprietary software platform, as well as our industry experience and knowledge gained from our original business, to expand the New Neighbor Guaranty program and to potentially develop other new products in the future.

Because we acquire and collect on the delinquent receivables of Associations, the Account debtors are third parties that we have little or no information about. Therefore, we cannot predict when any given Account will be paid off or how much it will yield. In assessing the risk of purchasing Accounts, we review the property values of the underlying units, the governing documents of the relevant Association, and the total number of delinquent receivables held by the Association.

As of December 31, 2015, we have since our inception, purchased an aggregate of approximately $285 million in Association receivables by funding a total of $12 million with respect to approximately 12,000 units across over 500 Associations in Florida, Washington and Colorado. Through December 31, 2015, we have, since our inception, received just under $110 million from approximately $216 million in purchased Accounts. From these purchased Accounts, we have recovered almost all of our principal investment of almost $12 million and earned about $32 million in revenues. Per our contracts, we have paid or recovered $11 million in legal fees and returned $57 million to our funded Associations.

Our Products

Original Product

Our original product relies upon Florida statutory provisions that effectively protect the principal amount invested by us in each Account. In particular, Section 718.116(1), Florida Statutes, makes purchasers and sellers of a unit in an Association jointly and severally liable for all past due assessments, interest, late fees, legal fees, and costs payable to the Association. In addition, the statute grants to Associations a so-called “super lien”, which is a category of lien that is given a statutorily higher priority than all other types of liens other than property tax liens. Under the Florida statute, a Florida Association’s super lien has higher priority than all other lien holders, except that in the case of property tax liens. The amount of the Association’s priority over a first mortgage holder that takes title to a property through foreclosure (or deed in lieu), referred to as the Super Lien Amount, is limited to twelve months’ past due

3

assessments or, if less, one percent (1.0%) of the original mortgage amount. Under our contracts with Associations for our original product, we pay Associations an amount up to the Super Lien Amount for the right to receive all collected interest and late fees on Accounts purchased from the Associations. In the past, to protect any amount invested by us in excess of the Super Lien Amount, we purchased insurance from an affiliate of AmTrust North America, or AmTrust, covering all assessments lost during the term of coverage due to a first mortgage foreclosure. As of January 28th, 2016 AmTrust has advised us that they will not continue to offer the insurance coverage we have purchased from them in the past. They represented to us that the nonrenewal is due solely to the fact that they have not generated the premium volume they anticipated.

In other states in which we offer our original product, which are currently only Washington, Colorado and as of February 2016, Illinois, we rely on statutes that we believe are similar to the above-described Florida statutes in relevant respects. A total of approximately 22 U.S. states, Puerto Rico and the District of Columbia have super lien statutes that give Association assessments super lien status under some circumstances, and of these states, we believe that all of these jurisdictions other than Alaska have a regulatory and business environment that would enable us to offer our original product to Associations in those states on materially the same basis. With respect to our original product, for the year ended December 31, 2015, we acquired 234 Accounts for $173,607 compared with 496 Accounts for $359,200 for the year ended December 31, 2014. We believe the decline in purchased Accounts acquired in 2015 as compared with 2014 was a result of a decline of our available capital in 2015, our focus on financing activities including our initial public offering, and general market conditions resulting in a greater dispersion of available units.

New Neighbor Guaranty

In 2012, we began development of a new product, the New Neighbor Guaranty, wherein an Association assigns substantially all of its outstanding indebtedness and accruals on its delinquent units to us in exchange for payments in an amount equal to the regular ongoing monthly or quarterly assessments for delinquent units when those amounts would be due to the Association. We assume both the payment and collection obligations for these assigned Accounts under this product. This simultaneously eliminates an Association’s balance sheet bad debts and assists the Association to meet its budget by receiving guaranteed assessment payments on its delinquent units and relieving the Association from paying legal fees and costs to collect its bad debts. We believe that the combined features of the product enhance the value of the underlying real estate in an Association and the value of an Association’s delinquent receivables.

Before we implement the New Neighbor Guaranty program, an Association typically asks us to conduct a review of its accounts receivable. After we have conducted the review, we inform the Association of which Accounts we are willing to purchase and the terms of such purchase. Once we implement the New Neighbor Guaranty program, we begin making scheduled payments to the Association on the Accounts as if the Association had non-delinquent residents occupying the units underlying the Accounts. Our New Neighbor Guaranty contracts typically allow us to retain all collection proceeds on each Account other than special assessments and accelerated assessment balances. Thus, the Association foregoes the potential benefit of a larger future collection in exchange for the certainty of a steady stream of immediate payments on the Account.

In the past, to protect any amount invested by us in excess of the Super Lien Amount, we purchased insurance from an affiliate of AmTrust North America, or AmTrust, covering all assessments lost during the term of coverage due to a first mortgage foreclosure. As of January 28th, 2016 AmTrust has advised us that they will not continue to offer the insurance coverage we have purchased from them in the past. They represented to us that the nonrenewal is due solely to the fact that they have not generated the premium volume they anticipated.

The New Neighbor Guaranty program represented approximately five percent (5%) of our overall revenue in 2015 in comparison to our original product, which accounted for approximately ninety-three percent (93%) of our overall revenue in the same period. The balance of our revenue from the period was from Accounts that are hybrids of the original product with varying splits and from income on real estate owned, or REO, units. As we continue to develop our New Neighbor Guaranty product, we expect it to make up continually larger portions of our total revenue.

As of December 31, 2015, our average investment per unit for currently active Accounts under our original product was approximately $983 and $462 for condo owners associations (COA) and home owners associations (HOA), respectively. We expect that this average investment size will not materially change for the foreseeable future. Current investment for active New Neighbor Guaranty Accounts as of December 31, 2015 averaged approximately $4,900 and $1,800 per unit for COAs and HOAs, respectively. This average will vary in the future depending on how quickly we add new Accounts and how quickly we are able to resolve those Accounts. The average continued payment to Associations that have the New Neighbor Guaranty program in place is $250 per month for each active Account as of December 31, 2015.

4

As of December 31, 2015, we have historically recovered approximately $3,800 for COAs and $1,300 for HOAs per Account in interest and late fee revenue for Accounts collected under our original product. Accounts under our New Neighbor Guaranty program are producing revenue to us of, on average, approximately $4,792 for COAs and $1,220 for HOAs, per Account as December 31, 2015 after the recovery of our purchase price or investment basis. The average total recovery under our New Neighbor Guaranty program at final settlement is approximately $9,500 for COAs and $4,400 for HOAs, per Account, and is expected to continue to increase.

With respect to our New Neighbor Guaranty product, for the year ended December 31, 2015 we acquired 97 Accounts for $105,000 compared with 67 Accounts for $19,000 for the year ended December 31, 2014.

Future Products

We are also developing other variations of our contracts with Associations in various states that we may introduce to the market in the future. For example, under one product under development, at the request of an Association lender we may contract with an Association to provide that the Association will have revenues equal to or more than 90% of budget or any other percentage the lender requests. If an Association is at 80% of budget and a lender requires it to maintain revenues of 90% of budget, this product would provide upfront capital to bring the Association to the 90% threshold and then make continuing payments to keep it there through the term of the loan. This minimizes the lender’s risk of delinquencies adversely affecting the loan’s repayment. Also, this would enable lenders to do business with more Associations than their previous underwriting guidelines would permit if Associations contract with us as part of the loan package. This product, along with other variations on our contracts with Associations in various states, remains under development, however, and there is no assurance that we will ultimately launch this product or any other variation on our contracts with Associations in any state.

Industry Overview

According to the Community Association Institute (“CAI”), as of January 2014, 65 million people lived in 328,500 Associations in the United States. As a percentage, homeowners associations account for between 51-55% of the total and condominium associations make up between 42-45% of the total, with cooperatives comprising the balance. Florida has nearly eight million residents living in more than 47,000 community associations. Assuming the national distribution of property types exists in Florida, Florida has approximately 24,000 homeowners associations and 20,000 condominium associations. For fiscal year ended December 31, 2015, we have contracted with approximately 450 community associations. We believe opportunity remains abundant in our other geographic markets. As of December 31, 2014, the state of Washington had more than 10,000 community associations and the state of Colorado had more than 9,000.

Associations typically address delinquencies by paying lawyers or collection agencies to recover amounts owed. While Associations seek recovery of delinquent amounts, budgets go underfunded causing the need to cut services or raise assessments further. The real estate downturn in 2008 made delinquency issues an acute problem for a large number of Associations. We were organized in 2008 to immediately address the financial problems faced by Associations as a result of delinquent unit owners.

According to the CAI, in Florida, where we have primarily operated, Associations annually assess their residents $9 billion and nationwide, annual assessments by Associations are $65 billion. We believe we are the largest purchaser of delinquent Accounts in Florida, with total purchases of approximately $250 million over a seven-year period. The balance of delinquent Accounts are serviced by lawyers, collection companies, or a handful of small competitors of us, or not serviced at all. We believe we offer Associations a better financial solution to Account delinquencies and that Associations will increasingly turn to us and our products as a solution to handle Account delinquencies.

5

Our Strategy

Our primary objective is to utilize our competitive strengths, including our proprietary technology and our management’s experience and expertise in buying and collecting Association Accounts, to grow our business in Florida and in other states by identifying, evaluating, pricing, and acquiring Association Accounts and maximizing collections of such Accounts in a cost efficient manner. The principal elements of our strategy are comprised of the following:

|

|

· |

Capitalizing on our brand and existing strategic relationships to identify and acquire Association Accounts. We market our “We Buy Problems” and “You Are Always Better off with LM Funding” brands primarily through trade shows throughout Florida and, to a lesser extent, at national events. Participation in these shows and events has enabled us to form strategic relationships throughout the Association services industry and has served to provide a positive reputation in the industry. We leverage our brand and strategic relationships with law firms and Associations to identify and purchase Accounts. |

|

|

· |

Partnering with Associations’ advisors such as law firms, management companies, accountants, Association lenders, and others to efficiently identify and acquire Accounts on a national basis. The point of purchase for Accounts is at the individual Association board of directors level; therefore, establishing and maintaining relationships with the advisors of those boards is important to our business strategy. Our strategic relationships with Association boards’ advisors provide us with opportunities to meet with Association boards on favorable terms and help us to gain their trust and confidence. |

|

|

· |

Providing our proprietary software to our partner law firms in order to cost effectively track, control, and collect purchased Accounts and maintain low fixed overhead. Our proprietary software enables law firms’ lawyers to efficiently handle approximately 1,000 accounts at a time with a high degree of uniformity and accuracy based upon historical caseload per lawyer of Business Law Group, P.A., one of our partner law firms. This enables our law firms to operate more efficiently and profitably, while simultaneously enabling us to cost effectively track and control our Accounts on a real-time basis. |

|

|

· |

Utilizing increased access to capital and lines of credit to expand our product offerings nationally. As a specialty finance company, capital is our inventory. Access to capital has always determined the speed of our growth and the amount of upfront funding we can provide with our products. We believe that increased access to capital will enable us to pursue more opportunities to buy Accounts and to develop a wider array of specialty finance products. |

|

|

· |

Extending secured commercial loans as a means to acquiring large blocks of Accounts. We intend to pursue the extension of secured loans to commercial partners who, as a condition of such loans, would be required to drive large blocks of accounts to us. Banks, management companies, law firms, and large Associations control large blocks of Accounts that we may be able to acquire if we help meet their capital needs. |

|

|

· |

Pursuing acquisitions of providers in the Association Account servicing industry. A number of smaller collection companies continue to operate in the community association market. Some have funded Accounts that we can acquire. Others have customer relationships which can serve as a valuable platform for selling our products. We will continue to explore opportunities to expand our footprint in both the states in which we operate and by looking to make strategic acquisitions in states we wish to expand to. |

Employees

As of March 25, 2016, we had 22 employees, of which 22 are full-time.

Corporate Information

LM Funding, LLC, our wholly-owned subsidiary, was originally organized in January 2008 as a Florida limited liability company. In preparation for our initial public offering in October 2015, we were incorporated in Delaware on April 20, 2015. Upon completion of our initial public offering, we became the holding company of LM Funding, LLC. All of our business is conducted through LM Funding, LLC and its subsidiaries.

6

Risks Relating to Our Business

We may not be able to purchase Accounts at favorable prices, or on sufficiently favorable terms, or at all.

Our success depends upon the continued availability of Association Accounts. The availability of Accounts at favorable prices and on terms acceptable to us depends on a number of factors outside our control, including:

(i) the status of the economy and real estate market in markets which we have operations may become so strong that delinquent Accounts do not occur in sufficient quantities to efficiently acquire them;

(ii) the perceived need of Associations to sell their Accounts to us as opposed to taking other measures to solve budget problems such as increasing assessments; and

(iii) competitive pressures from law firms, collections agencies, and others to produce more revenue for Associations than we can provide through the purchase of Accounts.

In addition, our ability to purchase Accounts, in particular with respect to our original product, is reliant on state statutes allowing for a Super Lien Amount to protect our principal investment; any change of those statutes and elimination of the priority of the Super Lien Amount, particularly in Florida, could have an adverse effect on our ability to purchase Accounts. If we were unable to purchase Accounts at favorable prices or on terms acceptable to us, or at all, it would likely have a material adverse effect on our financial condition and results of operations.

Our quarterly operating results may fluctuate and cause our stock price to decline.

Because of the nature of our business, our quarterly operating results may fluctuate, which may adversely affect the market price of our common stock. Our results may fluctuate as a result of the following factors:

(i) the timing and amount of collections on our Account portfolio;

(ii) our inability to identify and acquire additional Accounts;

(iii) a decline in the value of our Account portfolio recoveries;

(iv) increases in operating expenses associated with the growth of our operations; and

(v) general, economic and real estate market conditions.

We may not be able to recover sufficient amounts on our Accounts to recover charges to the Accounts for interest and late fees necessary to fund our operations.

We acquire and collect on the delinquent receivables of Associations. Since Account debtors are third parties that we have little to no information about, we cannot predict when any given Account will pay off or how much it will yield. In order to operate profitably over the long term, we must continually purchase and collect on a sufficient volume of Accounts to generate revenue that exceeds our costs.

We are subject to intense competition seeking to provide a collection solution to Associations for delinquent Accounts.

Lawyers, collection agencies, and other direct and indirect competitors vying to collect on Accounts all propose to solve the problem delinquent Accounts pose to Associations. Additionally, Associations and their management companies sometimes try to solve their delinquent Account problems in house, without the assistance of third-party collection agencies. An Account that an Association attempts to collect through any of these other options is an Account we cannot purchase and collect. We compete on the basis of reputation, industry experience, performance and financing dollars. Some of these competitors have greater contacts with Associations, greater financial resources and access to capital, more personnel, wider geographic presence and other resources than we have. In addition, we expect the entry of new competitors in the future given the relatively new nature of the market in which we operate. Aggressive pricing by our competitors could raise the price of acquiring and purchasing Accounts above levels that we are willing to pay, which could reduce the number of Accounts suitable for us to purchase or if purchased by us, reduce the profits, if any, generated by such Accounts. If we are unable to purchase Accounts at favorable prices or at all, the revenues generated by us and our earnings could be materially reduced.

7

We are dependent upon third-party law firms to service our Accounts.

Although we utilize our proprietary software and in-house staff to track, monitor, and direct the collection of our Accounts, we depend upon third-party law firms to perform the collection work. As a result, we are dependent upon the efforts of our third-party law firms, particularly Business Law Group, P.A. (“BLG”) to service and collect our Accounts. BLG presently services approximately 98% of our Accounts. Our revenues and profitability could be materially affected if:

(i) our agreements with the third-party law firms we use are terminated and we are not able to secure replacement law firms or direct payments from account debtors to our replacement law firms;

(ii) our relationships with our law firms adversely change;

(iii) our law firms fail to adequately perform their obligations; or

(iv) internal changes at such law firms occur, such as loss of staff who service us.

We may not be able to secure insurance to mitigate our risks.

In the past when the purchase price of an Account exceeds the amount protected by the Super Lien Amount, or if we purchased an Account in a jurisdiction without a super lien statute, we purchased insurance from AmTrust. This insurance formerly covered all principal assessments owed less the six month past-due assessment deductible for the term of the coverage. AmTrust was the only provider of such coverage, and it is not clear that any other insurance agency would be willing or able to provide such coverage at comparable rates to those offered by AmTrust. As of January 28th, 2016 AmTrust has advised us that they will not continue to offer the insurance coverage we have purchased from them in the past. They represented to us that the nonrenewal is due solely to the fact that they have not generated the premium volume they anticipated. Any newly purchased accounts will not be covered by this insurance policy. We may choose to seek alternative coverage in the future but insurability is not guaranteed.

If we are unable to access external sources of financing, we may not be able to fund and grow our operations.

We depend upon loans from external sources from time to time to fund and expand our operations. Our ability to grow our business is dependent on our access to additional financing and capital resources. The failure to obtain financing and capital as needed would limit our ability to purchase Accounts and achieve our growth plans.

In addition, some of our financing sources impose certain restrictive covenants, including financial covenants. Failure to satisfy any of these covenants could:

(i) cause our indebtedness to become immediately payable;

(ii) preclude us from further borrowings from these existing sources; and

(iii) prevent us from securing alternative sources of financing on favorable terms, if at all, necessary to purchase Accounts and operate our business.

We may not be successful at acquiring and collecting Accounts in other states profitably.

Our business strategy is dependent upon expanding our operations into other states and we have purchased and intend to continue to purchase Accounts in states in which we have little or no operating history. We may not be successful in acquiring any Accounts in these new markets and our limited experience in these markets may impair our ability to profitably or successfully collect the Accounts. This may cause us to overpay for these Accounts and consequently, fail to generate a profit from these Accounts. Our inability to acquire or profitably collect on Accounts in these states could have a material adverse effect on our financial condition and results of operations as we expand our business operations.

The Rodgers family will effectively control our company, substantially reducing the influence of our other stockholders.

Bruce M. Rodgers, our Chairman and Chief Executive Officer and his family, including trusts or custodial accounts of minor children of each of Mr. Rodgers and his wife Carollinn Gould, beneficially own in the aggregate more than 51% of our outstanding shares of common stock. As a result, the Rodgers family is able to significantly influence the actions that require stockholder approval, including the election of a majority of our directors and the approval of mergers, sales of assets or other corporate transactions or

8

matters submitted for stockholder approval. As a result, our other stockholders may have little or no influence over matters submitted for stockholder approval. In addition, the Rodgers family’s influence could deter or preclude any unsolicited acquisition of us and consequently materially adversely affect the price of our common stock.

We have experienced and expect to continue to experience significant growth and we may encounter difficulties managing our growth, which could disrupt our operations.

We have experienced significant growth since our inception, which has placed additional demands on our resources, and we expect to continue to experience significant growth. There can be no assurance that we will be able to manage our expanding operations effectively or that we will be able to maintain or accelerate our growth, and any failure to do so could adversely affect our ability to generate revenues and control expenses. Future growth will depend upon a number of factors, including:

(i) the effective and timely initiation and development of relationships with law firms, management companies, accounting firms and other trusted advisors of Associations willing to sell Accounts;

(ii) our ability to continue to develop our proprietary software for use in other markets and with different products;

(iii) our ability to maintain the collection of Accounts efficiently;

(iv) the recruitment, motivation and retention of qualified personnel both in our principal office and in new markets;

(v) our ability to successfully implement our business strategy in states outside of the state of Florida; and

(vi) our successful implementation of enhancements to our operational and financial systems.

Due to our limited financial resources and the limited experience of our management team, we may not be able to effectively manage the growth of our business. Our expected growth may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business strategy or disrupt our operations.

Government regulations may limit our ability to recover and enforce the collection of our Accounts.

Federal, state and municipal laws, rules, rules, regulations and ordinances may limit our ability to recover and enforce our rights with respect to the Accounts acquired by us. These laws include, but are not limited to, the following federal statutes and regulations promulgated thereunder and comparable statutes in states where account debtors reside and/or located:

(i) the Fair Debt Collection Practices Act;

(ii) the Federal Trade Commission Act;

(iii) the Truth-In-Lending Act;

(iv) the Fair Credit Billing Act;

(v) the Dodd-Frank Act;

(vi) the Equal Credit Opportunity Act; and

(vii) the Fair Credit Reporting Act.

We may be precluded from collecting Accounts we purchase where the Association or its prior legal counsel, management company, or collection agency failed to comply with applicable laws in charging the account debtor or prosecuting the collection of the Account. Laws relating to the collection of consumer debt also directly apply to our business. Our failure to comply with any laws applicable to us, including state licensing laws, could limit our ability to recover our Accounts and could subject us to fines and penalties, which could reduce our revenues.

9

We may become regulated under the Consumer Financial Protection Bureau, or CFPB, and have not developed compliance standards for such oversight.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (2010), or Dodd-Frank Act, represents a comprehensive overhaul of the financial services industry within the U.S. The Dodd-Frank Act allows consumers free access to their credit score if their score negatively affects them in a financial transaction or a hiring decision, and also gives consumers access to credit score disclosures as part of an adverse action and risk-based pricing notice. Title X of the Dodd-Frank Act establishes the Bureau of Consumer Financial Protection, or CFPB, within the Federal Reserve Board, and requires the CFPB and other federal agencies to implement many new and significant rules and regulations. Significant portions of the Dodd-Frank Act related to the CFPB became effective on July 21, 2011. The CFPB has broad powers to promulgate, administer and enforce consumer financial regulations, including those applicable to us and possibly our funded Associations. Under the Dodd-Frank Act, the CFPB is the principal supervisor and enforcer of federal consumer financial protection laws with respect to nondepository institutions, or “nonbanks”, including, without limitation, any “covered person” who is a “larger participant” in a market for other consumer financial products or services. We do not know if our unique business model makes us a covered person.

The CFPB has started to exercise authority to define unfair, deceptive or abusive acts and practices and to require reports and conduct examinations of these entities for purposes of (i) assessing compliance with federal consumer financial protections laws; (ii) obtaining information about the activities and compliance systems or procedures of such entities; and (iii) detecting and assessing risks to consumers and to markets for consumer financial products and services. The exercise of this supervisory authority must be risk-based, meaning that the CFPB will identify nonbanks for examination based on the risk they pose to consumers, including consideration of the entity’s asset size, transaction volume, risk to consumers, existing oversight by state authorities and any other factors that the CFPB determines to be relevant. When a nonbank is in violation of federal consumer financial protection laws, including the CFPB’s own rules, the CFPB may pursue administrative proceedings or litigation to enforce those laws and rules. In these proceedings, the CFPB can obtain cease and desist orders, which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief, and monetary penalties ranging from $5,000 per day for ordinary violations of federal consumer financial protection laws to $25,000 per day for reckless violations and $1 million per day for knowing violations. Also, where a company has violated Title X of the Dodd-Frank Act or CFPB regulations under Title X, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB (but not for civil penalties). If the CFPB or one or more state officials believe that we have committed a violation of the foregoing laws, they could exercise their enforcement powers in a manner that could have a material adverse effect on us.

At this time, we cannot predict the extent to which the Dodd-Frank Act or the resulting rules and regulations, including those of the CFPB, will impact the U.S. economy and our products and services. Compliance with these new laws and regulations may require changes in the way we conduct our business and could result in additional compliance costs, which could be significant and could adversely impact our results of operations, financial condition or liquidity.

Current and new laws may adversely affect our ability to collect our Accounts, which could adversely affect our revenues and earnings.

Because our Accounts are generally originated and collected pursuant to a variety of federal and state laws by a variety of third parties and may involve consumers in all 50 states, the District of Columbia and Puerto Rico, there can be no assurance that all Associations and their management companies, legal counsel, collections agencies and others have at all times been in compliance with all applicable laws relating to the collection of Accounts. Additionally, there can be no assurance that we or our law firms have been or will continue to be at all times in compliance with all applicable laws. Failure to comply with applicable laws could materially adversely affect our ability to collect our Accounts and could subject us to increased costs, fines, and penalties. Furthermore, changes in state law regarding the lien priority status of delinquent Association assessments could materially and adversely affect our business.

We may incur substantial indebtedness from time to time in connection with the purchase of Accounts and could be subject to risks associated with incurring such indebtedness, including:

(i) we could be required to dedicate a portion of our cash flows from operations to pay debt service costs and, as a result, we would have less funds available for operations, future acquisitions of Accounts, and other purposes;

(ii) it may be more difficult and expensive to obtain additional funds through financings, if such funds are available at all;

(iii) we could be more vulnerable to economic downturns and fluctuations in interest rates, less able to withstand competitive pressures and less flexible in reacting to changes in our industry and general economic conditions; and

10

(iv) if we default under any of our existing credit facilities or if our creditors demand payment of a portion or all of our indebtedness, we may not have sufficient funds to make such payments.

We have pledged substantially all of our assets to secure our borrowings.

Our existing indebtedness is, and any future indebtedness we incur may be, secured by substantially all of our assets. If we default under the indebtedness secured by our assets, the secured creditor could declare all of the indebtedness then outstanding to be immediately due and payable. If we were unable to pay such amounts, our assets would be available to the secured creditor to satisfy our obligations to the secured creditor.

We are subject to loan covenants that may restrict our ability to operate our business.

Our credit facilities impose certain restrictive covenants, including financial covenants, that restrict our ability to operate our business. Our credit facilities restrict us from undertaking additional indebtedness, a sale of substantially all of our assets, a merger, or other type of business consolidation. Failure to satisfy any of these covenants could result in all or any of the following:

(i) acceleration of the payment of our outstanding indebtedness;

(ii) cross defaults to and acceleration of the payment under other financing arrangements;

(iii) our inability to borrow additional amounts under our existing financing arrangements; and

(iv) our inability to secure financing on favorable terms or at all from alternative sources.

Class action suits and other litigation in our industry could divert our management’s attention from operating our business and increase our expenses.

Certain originators and servicers involved in consumer credit collection have been subject to class actions and other litigation. Claims include failure to comply with applicable laws and regulations such as usury and improper or deceptive origination and collection practices. If we become a party to such class action suits or other litigation, our management’s attention may be diverted from our everyday business activities and implementing our business strategy, and our results of operations and financial condition could be materially adversely affected.

Any future acquisitions that we make may prove unsuccessful or strain or divert our resources.

We may seek to grow through acquisitions of related businesses. Such acquisitions present risks that could materially adversely affect our business and financial performance, including:

(i) the diversion of our management’s attention from our everyday business activities;

(ii) the assimilation of the operations and personnel of the acquired business;

(iii) the contingent and latent risks associated with the past operations of, and other unanticipated problems arising in, the acquired business; and

(iv) the need to expand our management, administration and operational systems to accommodate such acquired business.

If we make such acquisitions we cannot predict whether:

(i) we will be able to successfully integrate the operations of any new businesses into our business;

(ii) we will realize any anticipated benefits of completed acquisitions; or

(iii) there will be substantial unanticipated costs associated with such acquisitions.

11

In addition, future acquisitions by us may result in potentially dilutive issuances of our equity securities, the incurrence of additional debt, and the recognition of significant charges for depreciation and amortization related to goodwill and other intangible assets.

Although we have no definitive plans or intentions to make acquisitions of related businesses, we continuously evaluate such potential acquisitions. However, we have not reached any agreement or arrangement with respect to any particular acquisition and we may not be able to complete any acquisitions on favorable terms or at all.

Our investments in other businesses and entry into new business ventures may adversely affect our operations.

We have made and may continue to make investments in companies or commence operations in businesses and industries that are not identical to those with which we have historically been successful. If these investments or arrangements are not successful, our earnings could be materially adversely affected by increased expenses and decreased revenues.

If our technology and software systems are not operational, our operations could be disrupted and our ability to successfully acquire and collect Accounts could be adversely affected.

Our success depends in part on our proprietary software. We must record and process significant amounts of data quickly and accurately to properly track, monitor and collect our Accounts. Any failure of our information systems and their backup systems would interrupt our operations. We may not have adequate backup arrangements for all of our operations and we may incur significant losses if an outage occurs. In addition, we rely on third-party law firms who also may be adversely affected in the event of an outage in which the third-party servicer does not have adequate backup arrangements. Any interruption in our operations or our third-party law firms’ operations could have an adverse effect on our results of operations and financial condition.

Our organizational documents and Delaware law may make it harder for us to be acquired without the consent and cooperation of our Board of Directors and management.

Certain provisions of our organizational documents and Delaware law may deter or prevent a takeover attempt, including a takeover attempt in which the potential purchaser offers to pay a per share price greater than the current market price of our common stock. Under the terms of our certificate of incorporation, our Board of Directors has the authority, without further action by our stockholders, to issue shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. In addition, our directors serve staggered terms of one to three years each and, as such, at any given annual meeting of our stockholders, only a portion of our Board of Directors may be considered for election, which may prevent our stockholders from replacing a majority of our Board of Directors at certain annual meetings and may entrench our management and discourage unsolicited stockholder proposals. The ability to issue shares of preferred stock could tend to discourage takeover or acquisition proposals not supported by our current Board of Directors.

Future sales of our common stock may depress our stock price.

Sales of a substantial number of shares of our common stock in the public market could cause a decrease in the market price of our common stock. We had 3,300,000 shares of common stock issued and outstanding as of December 31, 2015. We may issue additional shares in connection with our business and may grant stock options to our employees, officers, directors and consultants under our stock option plans or warrants to third parties. If a significant portion of these shares were sold in the public market, the market value of our common stock could be adversely affected.

We have limited experience with the performance of our New Neighbor Guaranty program and actual results may differ from our models and projections.

Our business strategy is dependent upon expanded use of our New Neighbor Guaranty program. Although our original product continues to generate revenue, we have experienced issues with turnover on the boards of directors of Associations we service because the new board members fail to recognize the benefit of our original product. We have limited operating history with the New Neighbor Guaranty program and we will not have sufficient actual performance data regarding the New Neighbor Guaranty program for at least several more years, if ever. If our models and projections for the New Neighbor Guaranty program are overstated, use of the New Neighbor Guaranty program may impair our ability to operate profitably. Our inability to profit from our New Neighbor Guaranty Accounts could have a material adverse effect on our financial condition and results of operations as we attempt to expand our business operations.

12

Risks Relating to the Accounts

Insolvency of BLG could have a material adverse effect on our financial condition, results of operations and cash flows.

Our primary Account servicer, BLG, deposits collections on the Accounts in its Interest on Lawyers Trust Account (“IOLTA Trust Account”) and then distributes the proceeds to itself, us and the Associations pursuant to the terms of the purchase agreements with the Associations and applicable law. We do not have a perfected security interest in the amounts BLG collects on the Accounts while such amounts are held in the IOLTA Trust Account. BLG has agreed to promptly remit to us all amounts collected on the Accounts that are owed to us. If, however, BLG were to become subject to any insolvency law and a creditor or trustee-in-bankruptcy of BLG were to take the position that proceeds of the Accounts held in BLG’s IOLTA Trust Account should be treated as assets of BLG, an Association or another third party, delays in payments from collections on the Accounts held by BLG could occur or reductions in the amounts of payments to be remitted by BLG to us could result, which could adversely affect our financial condition, results of operations and cash flows.

Associations do not make any guarantee with respect to the validity, enforceability or collectability of the Accounts acquired by us.

Associations do not make any representations, warranties or covenants with respect to the validity, enforceability or collectability of Accounts in their assignments of Accounts to us. If an Account proves to be invalid, unenforceable or otherwise generally uncollectible, we will not have any recourse against the respective Association. If a significant number of our Accounts are later held to be invalid, unenforceable or are otherwise uncollectible, our financial condition, results of operations and cash flows could be adversely affected.

The vast majority of our Accounts are located in Florida, and any adverse conditions affecting Florida could have a material adverse effect on our financial condition and results of operations.

Our primary business relates to revenues from Accounts purchased by us, which are almost all based in Florida, and our primary source of revenue consists of payments made by condominium and home owners to satisfy the liens against their condominiums and homes. As of December 31, 2014 and December 31, 2015, Florida represented 99% and 99%, respectively, of our Accounts. An economic recession, adverse market conditions in Florida, and/or significant property damage caused by hurricanes, tornadoes or other inclement weather could adversely affect the ability of these condominium and home owners to satisfy the liens against their condominiums and homes, which could, in turn, have a material adverse effect on our financial condition and results of operations.

Foreclosure on an Association’s lien may not result in the Company recouping the amount that we invested in the related Account.

All of the Accounts purchased by us are in default. The Accounts are secured by liens held by Associations, which we have an option to foreclose upon on behalf of the Associations. Should we foreclose upon such a lien on behalf of an Association, we are generally entitled pursuant to our contractual arrangements with the Association to have the Association quitclaim its interests in the condominium unit or home to us. In the event that any Association quitclaims its interests in a condominium unit or home to us, we will be relying on the short-term rental prospects, to the extent permitted under bylaws and rules applicable to the Association, and value of its interest in the underlying property, which value may be affected by numerous risks, including:

(i) changes in general or local economic conditions;

(ii) neighborhood values;

(iii) interest rates;

(iv) real estate tax rates and other operating expenses;

(v) the possibility of overbuilding of similar properties and of the inability to obtain or maintain full occupancy of the properties;

(vi) governmental rules and fiscal policies;

(vii) acts of God; and

(viii) other factors which are beyond our control.

13

It is possible that as a result of a decrease in the value of the property or any of the other factors referred to in this paragraph, the amount realized from the sale of such property after taking title through a lien foreclosure may be less than our total investment in the Account. If this occurs with regard to a substantial number of Accounts, the amount expected to be realized from the Accounts will decrease and our financial condition and results of operations could be harmed.

If Account debtors or their agents make payments on the Accounts to or negotiate reductions in the Accounts with an Association, it could adversely affect our financial condition, results of operations and cash flows.

From time to time account debtors and/or their agents may make payments on the Accounts directly to the Association or its management company. Our sole recourse in this instance is to recover these misapplied payments through set-offs of payments later collected for that Association by our third-party law firms. A significant number of misapplied or reduced payments could hinder our cash flows and adversely affect our financial condition and results of operations.

Account debtors are subject to a variety of factors that may adversely affect their payment ability.

Collections on the Accounts have varied and may in the future vary greatly in both timing and amount from the payments actually due on the Accounts due to a variety of economic, social and other factors. Failures by account debtors to timely pay off their Accounts could adversely affect our financial condition, results of operations and cash flows.

Defaults on the Accounts could harm our financial condition, results of operations and cash flows.

We take assignments of the lien foreclosure rights of Associations against delinquent units owned by account debtors who are responsible for payment of the Accounts. The payoff of the Accounts is dependent upon the ability and willingness of the condominium and home owners to pay such obligations. If an owner fails to pay off the Account relating to his, her or its unit or home, only net amounts, if any, recovered will be available with respect to that Account. Foreclosures by holders of first mortgages generally result in our receipt of reduced recoveries from Accounts. In addition, foreclosure actions by any holder of a tax lien may result in us receiving no recovery from an Account to the extent excess proceeds from such tax lien foreclosure are insufficient to provide for payment to us. If, at any time, (i) we experience an increase in mortgage foreclosures or tax lien foreclosures or (ii) we experience a decrease in owner payments, our financial condition, results of operations and cash flows could be adversely affected.

We depend on the skill and diligence of third parties to collect the Accounts.

Because the collection of Accounts requires special skill and diligence, any failure of BLG, or any other law firm utilized by us, to diligently collect the Accounts could adversely affect our financial condition, results of operations and cash flows.

The payoff amounts received by us from Accounts may be adversely affected due to a variety of factors beyond our control.

Several factors may reduce the amount that can be collected on any individual Account. The delinquent assessments that are the subject of the Accounts and related charges are included within an Association’s claim of lien under the applicable statute. In Florida, Association liens are recorded in the official county records and hold first priority status with respect to a first mortgage holder for an amount equal to the Super Lien Amount. Associations have assigned to us the right to direct law firms to collect on the liens and foreclose, subject to the terms and conditions of the purchase agreements between each Association and us.

Each Account presents a separate risk as to the creditworthiness of the debtor obligated to pay the Account, which, in general, is the owner of the unit or home when the Account was incurred and subsequent owners. For instance, if the debtor has incurred a property tax lien, a sale related to such lien could result in our complete loss of the Account. Also, a holder of a first mortgage taking title through a foreclosure proceeding in which the Association is named as a defendant must only pay the Super Lien Amount in a state with a super lien statute. Although we purchase Accounts at a discount to the outstanding balance and the owner remains personally liable for any deficiency, we may decide that it is not cost-effective to pursue such a deficiency. As a result, the purchase or ownership of a significant number of Accounts which result in payment of only the Super Lien Amount or less where no statute specifying a Super Lien Amount applies, could adversely affect our financial condition and results of operations.

The liens securing the Accounts we own may not be superior to all liens on the related units and homes.

Although the liens of the Associations securing the Accounts may be superior in right of payment to some of the other liens on a condominium unit or home, they may not be superior to all liens on that condominium unit or home. For instance, a lien relating to delinquent property taxes would be superior in right of payment to the liens securing the Accounts. In addition, if an Association fails to assert the priority of its lien in a foreclosure action, the Association may inadvertently waive the priority of its lien. In the event that

14

there is a lien of superior priority on a unit or home relating to one of the Accounts, the Association’s lien might be extinguished in the event that such superior liens are foreclosed. In most instances, the unit or home owner will be liable for the payment of such Account and the ultimate payment would depend on the creditworthiness of such owner. In the case of a tax lien foreclosure, an owner taking title through foreclosure would not be liable for the payment of obligations that existed prior to the foreclosure sale. The purchase or ownership of a significant number of Accounts that are the subject of foreclosure by a superior lien could adversely affect our financial condition, results of operations and cash flows.

We may not choose to pursue a foreclosure action against condominium and home owners who are delinquent in paying off the Accounts relating to their units or homes.

Although we have the right to pursue a foreclosure action against a unit or home owner who is delinquent in paying off the Account relating to his or her unit or home, we may not choose to do so as the cost of such litigation may be prohibitive, especially when pursuing an individual claim against a single unit or home owner. Our choice not to foreclose on a unit or home may delay our ability to collect on the Account. If we decide not to pursue foreclosure against a significant number of Accounts, it could adversely affect our financial condition, results of operations and cash flows.

The holding period for our Accounts from purchase to payoff is indeterminate.

It can take our third-party law firms anywhere from three months to four years or longer to collect on an Account. Approximately 75% of our Accounts were purchased prior to 2013, with some being purchased as early as 2008. Due to various factors, including those discussed above, we cannot project the payoff date for any Account. This indeterminate holding period reduces our liquidity and ability to fund our operations. If our ability to collect on a material number of Accounts was significantly delayed, it could adversely affect our cash flows and ability to fund our operations.

Our business model and related accounting treatment may result in acceleration of expense recognition before the corresponding revenues can be recognized.

As we expand our business, we may incur significant upfront costs relating to the acquisition of Accounts. Under United States generally accepted accounting principles (“GAAP”) such amounts may be required to be recognized in the period that they are expended. However, the corresponding revenue stream relating to the acquisition of such Accounts will not be recognized until future dates. Therefore, we may experience reduced earnings in earlier periods until such time as the revenue stream relating to the acquisition of such Accounts may be recognized.

Risks Relating to our Securities

Future sales of our common stock by our affiliates or other stockholders may depress our stock price.

Sales of a substantial number of shares of our common stock in the public market could cause a decrease in the market price of our common stock. We had authorized 10,000,000 and 5,000,000 shares of common stock and preferred stock, respectively as of December 31, 2015. We had 3,300,000 shares of common stock issued and outstanding as of December 31, 2015. In addition, pursuant to our 2015 Omnibus Incentive Plan, options to purchase 94,500 shares of our common stock were outstanding as of December 31, 2015, of which 8,663 were exercisable. Lastly, there are 1,200,000 warrants issued and outstanding as of December 31, 2015. We may also issue additional shares in connection with our business and may grant additional stock options or restricted shares to our employees, officers, directors and consultants under our present or future equity compensation plans or we may issue warrants to third parties outside of such plans. If a significant portion of these shares were sold in the public market, the market value of our common stock could be adversely affected.

The market price and trading volume of our units, shares of common stock and warrants may be volatile, and you may not be able to resell your shares of common stock or warrants (as the case may be) at or above the price you paid for them.

Our securities may trade at prices significantly below the price you paid for it in which case, holders of our securities may experience difficulty in reselling, or an inability to sell, our securities. In addition, when the market price of a company’s equity drops significantly, equity holders often institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources away from the day-to-day operations of our business.

15

We are a “controlled company” within the meaning of the rules of The NASDAQ Capital Market and, as a result, expect to qualify for, and may to rely on, exemptions from certain corporate governance requirements. You will not have the same protections afforded to stockholders of companies that are subject to such requirements.

Entities controlled by Bruce M. Rodgers, our Chairman and Chief Executive Officer, and Carollinn Gould, our Vice President-General Manager and director, control a majority of the voting power of our common stock. As a result, we are a “controlled company” within the meaning of the corporate governance standards of The NASDAQ Capital Market. Under NASDAQ Capital Market rules, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements, including:

|

|

· |

the requirement that a majority of the board of directors consist of independent directors; |

|

|

· |

the requirement that we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

|

|

· |

the requirement that we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

|

|

· |

the requirement for an annual performance evaluation of the nominating and corporate governance and compensation committees. |

We elected to utilize some of these exemptions, namely the exemption relating to the requirement to have all independent directors on the nominating and corporate governance committee. We may also elect to utilize other exemptions in the future so long as we continue to qualify as a “controlled company.” If we utilize these exemptions we may not have a majority of independent directors and our nominating and corporate governance and compensation committees will not consist entirely of independent directors and such committees will not be subject to annual performance evaluations. Accordingly, you will not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of The NASDAQ Capital Market.

We will incur increased costs as a result of being a public company.

As a public company, the Sarbanes-Oxley Act and related rules and regulations of the SEC and the various trading markets (including The NASDAQ Capital Market) regulate the corporate governance practices of public companies. Compliance with these requirements will increase our expenses and make some activities more time consuming than they have been in the past when we were a private company. Such additional costs going forward could negatively impact our financial condition and results of operations.

Securities analysts may not initiate coverage of our securities or may issue negative reports, which may adversely affect the trading price of our securities.

We cannot assure you that securities analysts will cover our company. As of December 31, 2015, no securities analyst cover our company. If securities analysts do not cover our company, this lack of coverage may adversely affect the trading price of our securities. The trading market for our securities will rely in part on the research and reports that securities analysts publish about us and our business. If one or more of the analysts who cover our company downgrades our securities, the trading price of our securities may decline. If one or more of these analysts ceases to cover our company, we could lose visibility in the market, which, in turn, could also cause the trading price of our securities to decline. Further, because of our small market capitalization, it may be difficult for us to attract securities analysts to cover our company, which could significantly and adversely affect the trading price of our securities.

If we do not maintain an effective registration statement, you may not be able to exercise the warrants in a cash exercise.

For you to be able to exercise the warrants, the resale of the shares of common stock to be issued to you upon exercise of the warrants must be covered by an effective and current registration statement. We cannot guarantee that we will continue to maintain a current registration statement relating to the resale of the shares of common stock underlying the warrants. In such circumstances, you would be unable to exercise the warrants in a cash exercise and will be required to engage in a cashless exercise in which a number of warrant shares equal to the fair market value of the exercised shares will be withheld. In those circumstances, we may, but are not required to, redeem the warrants by payment in cash. Consequently, there is a possibility that you will never be able to exercise the warrants and receive the underlying shares of common stock. This potential inability to exercise the warrants in a cash exercise, our right to cancel the warrants under certain circumstances, and the possibility that we may redeem the warrants for nominal value, may have an adverse effect on demand for the warrants and the prices that can be obtained from reselling them.

16

We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our securities less attractive to investors.

We are an “emerging growth company,” or EGC, as defined in the JOBS Act. We will remain an EGC until the earlier of: (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of the fiscal year following the fifth anniversary of the date of our initial public stock offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC, which means the first day of the year following the first year in which the market value of our common stock that is held by non-affiliates exceeds $700 million as of June 30. For so long as we remain an EGC, we are permitted to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

|

|

· |

being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

|

|

· |

not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting; |

|

|

· |

not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

|

|

· |

reduced disclosure obligations regarding executive compensation; |

|

|

· |

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved; and |

|

|

· |

the ability to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. |

We may choose to take advantage of some or all of the available exemptions. We have taken advantage of reduced reporting burdens in this report. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. We cannot predict whether investors will find our warrants or common stock less attractive if we rely on certain or all of these exemptions. If some investors find our warrants or common stock less attractive as a result, there may be a less active trading market for our warrants or common stock and the price of our warrants or common stock may be more volatile.

Item 1B. Unresolved Staff Comments.

None

Our executive and administrative offices are located in Tampa, Florida, where we lease approximately 11,000 square feet of general office space for approximately $14,000 per month, plus utilities. The lease was renewed March 2, 2014 and expires on July 31, 2019.

We believe that our existing facilities are adequate for our current needs.

Other than the lawsuits described below, we are not currently a party to material litigation proceedings. However, we frequently become party to litigation incident to the ordinary course of business, including either the prosecution or defense of claims arising from contracts by and between us and client Associations. Regardless of the outcome, litigation can have an adverse impact on us because of prosecution, defense and settlement costs, diversion of management resources and other factors.

Solaris at Brickell Bay Condominium Association, Inc. v. LM Funding, LLC, Case No: 2014-20043-C, was brought before the Circuit Court of the Eleventh Judicial Circuit, Miami-Dade Civil Division on July 31, 2014. On May 4, 2011, we entered into a Delinquent Assessments Proceeds Purchase Agreement with the plaintiff (the “Solaris Agreement”). On February 13, 2014, the plaintiff notified us of its intent to rescind the Solaris Agreement, claiming that we had failed to foreclose on Accounts assigned to us under the Solaris Agreement. In response, we requested that the plaintiff pay amounts we believe to be owed to us under the Solaris Agreement. In its complaint, the plaintiff alleges claims such as a usurious loan transaction, state and federal civil Racketeer

17